The number of Americans collecting jobless benefits last week is at its highest level since November, a sign the labor market is cooling as the Federal Reserve tries to lower inflation by slowing economic growth.

Applications for jobless aid for the week ending July 30 rose by 6,000 to 260,000, matching an eight-month high set two weeks ago, the Labor Department reported Thursday. First-time applications generally reflect layoffs.

The four-week average for claims, which evens out the weekly ups and downs, also rose from the previous week, to nearly 255,000. Jobless claims have been steadily rising since hitting a 50-year low in early April.

“The direction of filings has changed. from sustained declines to an uptrend, signaling a shift in the labor market. Overall, further interest rate increases will result in a rebalancing in supply and demand for workers, and a further rise in layoffs over coming months,” Rubeela Farooqi, chief U.S. economist at High Frequency Economics, said in note.

Earlier this week, the government reported that American employers posted fewer job openings in June. Openings fell from 11.3 million in May to a still-robust 10.7 million in June, meaning there are 1.8 open jobs for every unemployed worker. Before l2021, openings never exceeded 8 million in a month.

“While the labor market may be getting marginally cooler, overall demand for workers continues to exceed the supply,” Nancy Vanden Houten, lead U.S. economist at Oxford Economics, said in a research note. “Given that imbalance between the supply and demand for workers, we think employers are more likely to first slow hiring rather than lay off workers as the economy slows.”

Slowing job growth

The Labor Department’s jobs report for July, due out Friday, is expected to show that employers tacked on another 250,000 jobs last month, which would be a healthy number in normal times but would be the lowest since December 2020. Economists expect the unemployment rate to hold at 3.6% for the fifth straight month.

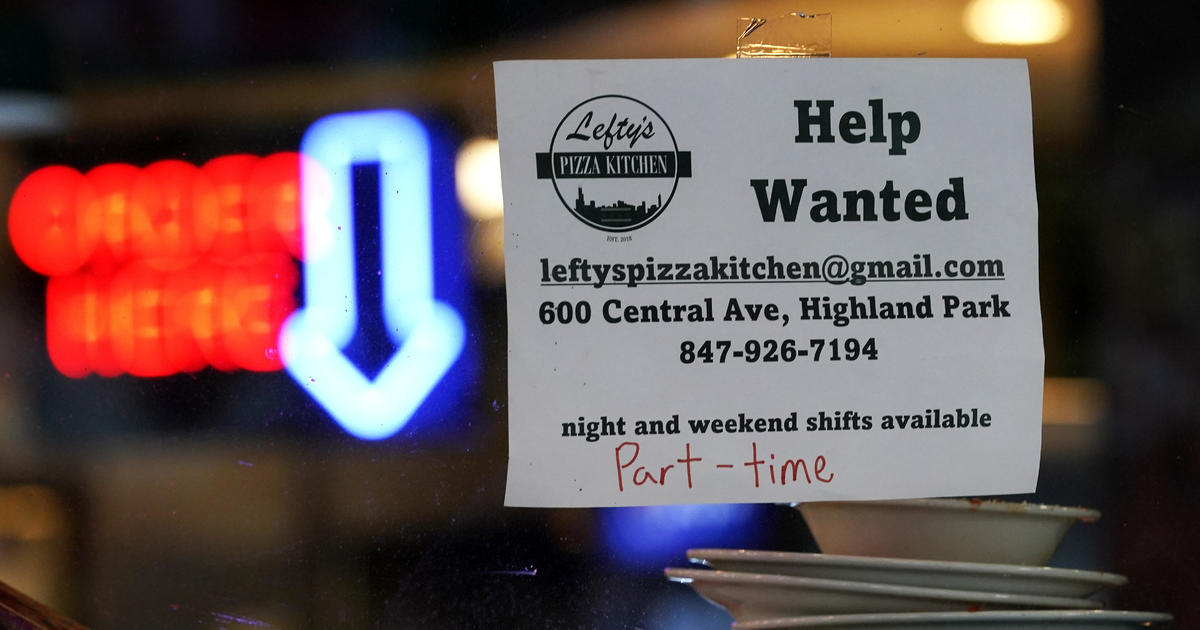

Though the labor market is still considered strong, there have been some high-profile layoffs announced recently by companies including Carvana, Coinbase, Netflix, Redfin and Tesla. A host of other companies, particularly in the tech sector, have announced hiring freezes.

Other indicators point to some weakness in the U.S. economy. The government said last week that the U.S. economy shrank 0.9% in the second quarter, the second straight quarterly contraction.

Consumer prices are still soaring, up 9.1% in June compared with a year earlier, the biggest yearly increase in four decades. In response, the Federal Reserve raised its main borrowing rate by another three-quarters of a point last week. That follows June’s three-quarter point hike and another half-point increase in May.

Higher rates have already sent home sales tumbling, made the prospect of buying a new car more burdensome and pushed credit card rates up.

All of those factors paint a divergent and confusing picture of the post-pandemic economy: Inflation is hammering household budgets, forcing consumers to pull back on spending, and growth is weakening, heightening fears the economy could fall into recession.